Today, a Wall Street Journal investing lesson chat session was prompted by BitcoinNe.ws to comment about bitcoin as a 2013 investment in its closing remarks. After first deleting the question from the que and not responding, we asked a few more times about bitcoin in the chat room full of crickets.

Today, a Wall Street Journal investing lesson chat session was prompted by BitcoinNe.ws to comment about bitcoin as a 2013 investment in its closing remarks. After first deleting the question from the que and not responding, we asked a few more times about bitcoin in the chat room full of crickets.

Charles Rotblut started off saying bitcoin will be “worthless” eventually and continued to spout off false associations with the gold rush, adoption rates and decentralization. He finished up with, “Bitcoin is interesting, but extremely speculative.”

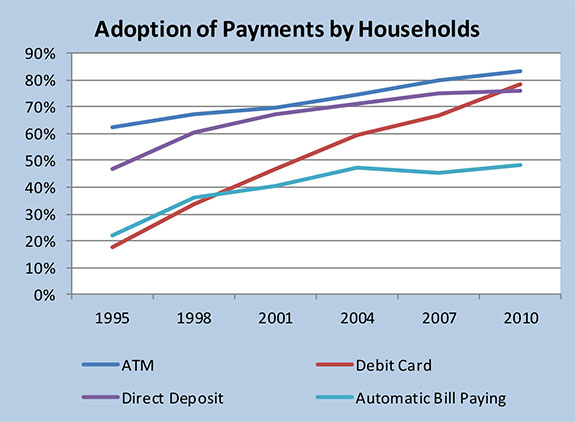

As you can see on this dated chart below, adoption rates for payment methods ramp up over time and are not just instantly adopted. Bitcoin is beating the pants off what we have seen in old technologies as popular wallet services and exchanges already service millions of customers. 2013 was a huge year for bitcoin merchant companies, like bitpay, who has boasted over 6000% increases in transactions compared when to 2012.

If you’re young, ask your parents how long it took their local convenience store to accept checks or credit cards when everyone was using cash. I remember when Albertsons started accepting credit cards when I was a kid.. rolling that transfer paper machine back and forth a million times to get a decent impression.

Then debit cards came out and took the market by storm, moving from being used by only < 20% of the population in 1995 to almost 80% by 2010.

Bitcoin will be the next big thing and we will see this happen faster than ever before.

Traditional financial institutions, like the ones on WSJ today, will continue to talk to empty chat rooms and ultimately be left in the dust as they have no vision of the future.

Pingback: BitcoinNe.ws | Bitcoin is live at Overstock.com!

Pingback: BitcoinNe.ws | Will you accept Bitcoin soon?